are union dues tax deductible in 2020

Thank you for your time. Educator expense tax deduction renewed for 2020 tax returns.

Give Me A Tax Break Union Dues Changes And More On The Horizon Barnes Thornburg

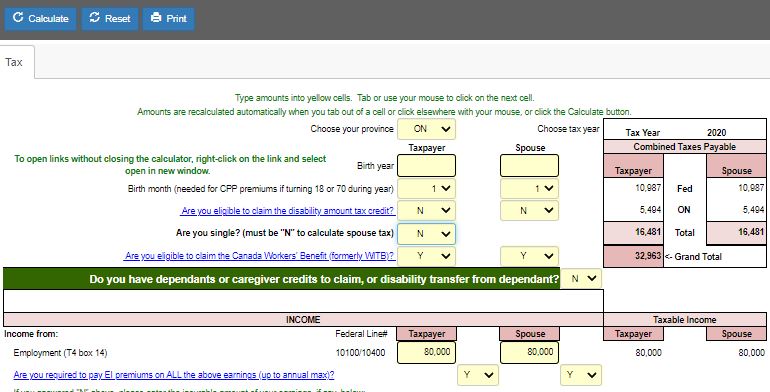

The amount of union dues that you can claim is shown in box 44 of your T4 slips or on your receipts and includes any GSTHST you paid.

. Tax Deduction of Your TALB Dues. However if the taxpayer is self-employed and pays union dues those dues are deductible as a business expense. Im a union Ironworker Ill be filing single and have made 41000 will my tools welding hoods etc still be a deduction and will my union dues be a deduction as well.

Job-related expenses arent fully deductible as they are subject to the 2 rule. You can claim a tax deduction for these amounts on line 21200 on your tax return. Its confusing because in prior years union dues and expenses were deductible on Schedule A.

The Tax Fairness for Workers Act was proposed on April 15 2021 by Democratic Senators Chuck Schumer of New York Bob Casey of Pennsylvania. Union dues may be deductible from California income taxes if you qualify to itemize on your California tax. Eligible educators can deduct up to 250 of qualified expenses you paid in 2020.

Taxpayer is clergy Now Im wondering just hypothetically whether union dues on a clergy return could be used as a deduction for self-employment tax. I just did a return with Housing Allowance listed there. If you are self-employed you can enter your union dues as a Schedule C business expense.

Deduction for excess premium. If you are an employee you can claim your union dues as a job-related expense if you itemize deductions. Miscellaneous itemized deductions are those.

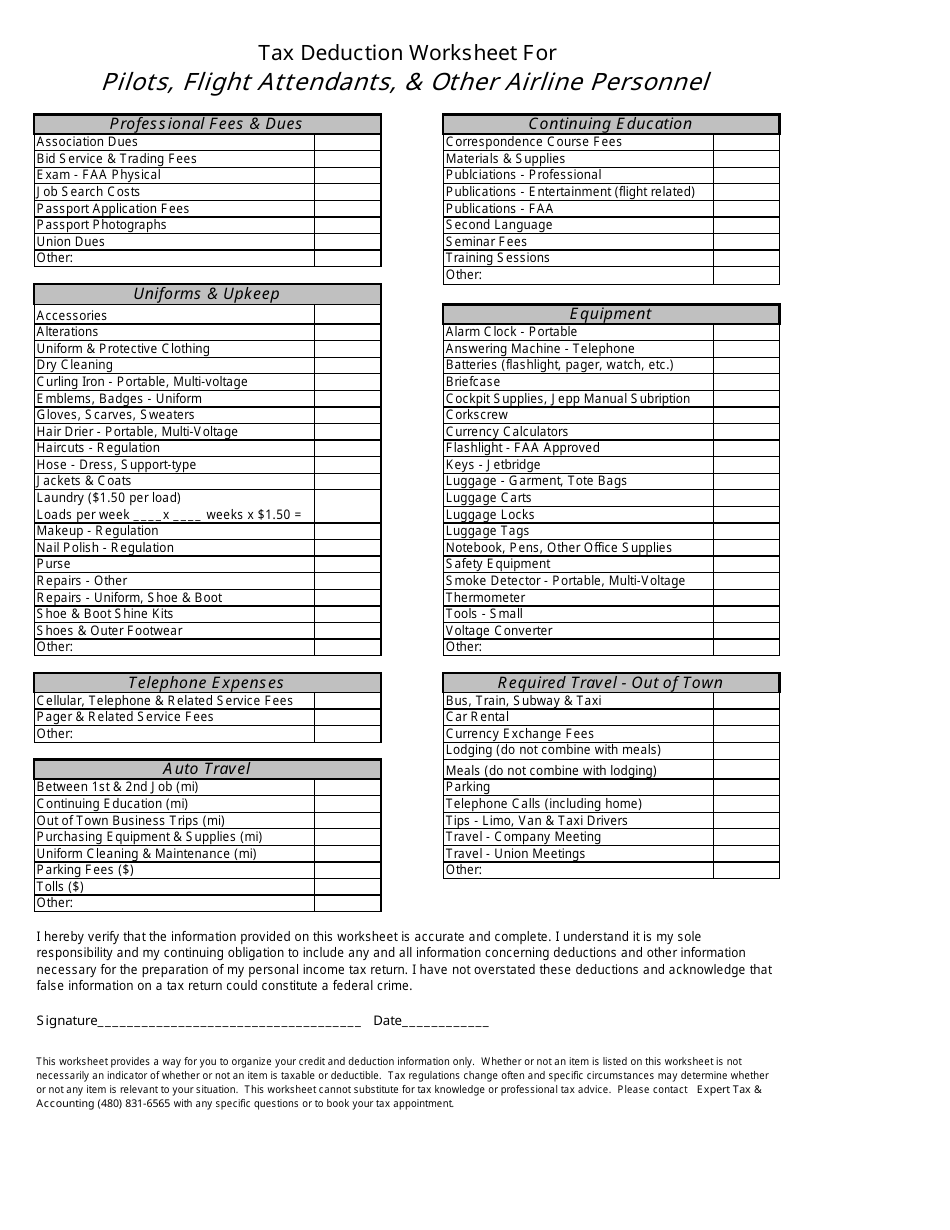

The Tax Fairness for Workers Act has been proposed to reinstate deductions for union dues and other employee expenses that are not reimbursed such as travel expenses and expenses for tools and uniforms. Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your employement. Are Guild dues tax deductible.

Tax reform changed the rules of union due deductions. Please note that tax payers can now itemize deductions on state taxes even if they do not itemize on federal taxes. That would be fun to explain to a programmer.

UNION DUES ARE NO LONGER TAX DEDUCTIBLE For tax years 2018 through 2025 union dues are no longer deductible on your federal income tax return even if itemized deductions are taken. Line 21200 was line 212 before tax year 2019. The amount of dues collected from employees represented by unions is subject to federal and state laws and court rulings.

Consult your tax advisor to confirm. Effective in 2019 union members can NOW deduct their union dues from state taxes provided they itemize deductions. With this new state tax benefit in effect it is projected to give back approximately 35 million to union members.

Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union dues too. Are union dues tax deductible 2020. Federal law allows unions and employers to enter.

As a part of your profession you may be a member of a trade union which you pay fees for in order to access member benefits. Union fees are typically collected monthly which you should budget for but the great news is that all your union fees. The NLRA allows unions and employers to enter into union-security agreements which require the payment of dues or dues equivalents as a condition of employment.

This is a result of the tax reform bill signed into law on December 22 2017. If youre the primary beneficiary of the union dues and your employer pays them on your behalf you cannot claim a tax. If this occurs treat the excess as an itemized deduction on your Schedule A Form 1040.

As a result of the Tax Cuts and Jobs Act TCJA that Congress passed and was signed into law on December 22 2017 employees can no longer deduct union dues from their federal income tax in years 2018-2025. A reminder for tax season. To enter your union dues for work performed as.

This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall into one of the qualified categories of employment claiming a deduction relating to unreimbursed employee expenses. However the job-related expenses deduction is still available to people who work in one of these specific professions or situations. Professional board dues required under provincial or territorial law.

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. Ad Easy Software To Help You Find All the Tax Deductions You Deserve. June 3 2019 1127 AM.

No Matter Your Filing Situation Add Tax Deductions Free. However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017. Annual dues for membership in a trade union or an association of public servants.

On certain bonds such as bonds that pay a variable rate of interest or that provide for an interest-free period the amount of bond premium allocable to a period may exceed the amount of stated interest allocable to the period. Are union fees 100 tax deductible. And yes the clergy do have unions in Great Britain and Canada.

Tax reform eliminated the deduction for union dues for tax years 2018-2025.

Union Dues Deductible On State Taxes Not On Federal Taxes Hawaii State Teachers Association

Union Professional And Other Dues For Medical Residents Md Tax

A Tax Break For Union Dues Wsj

Income Tax In India Guide It Returns E Filing Process 2020

Direct Tax Vivad Se Vishwas Scheme 2020 Detailed Analysis

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Revised Withholding Tax Table For Compensation

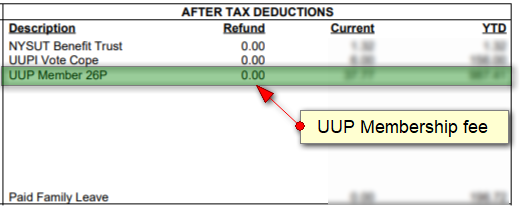

Deducting Union Dues On Nys Taxes Uup Buffalo Center

How To Effectively Save Tax With A Salary Of 15 Lpa In India Vakilsearch

2020 Year End Tax Tips For Canadians Cloudtax Simple Tax Application

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Taxtips Ca 2020 Canadian Income Tax And Rrsp Savings Calculator

Tax Deduction Worksheet For Pilots Flight Attendants Other Airline Personnel Download Printable Pdf Templateroller

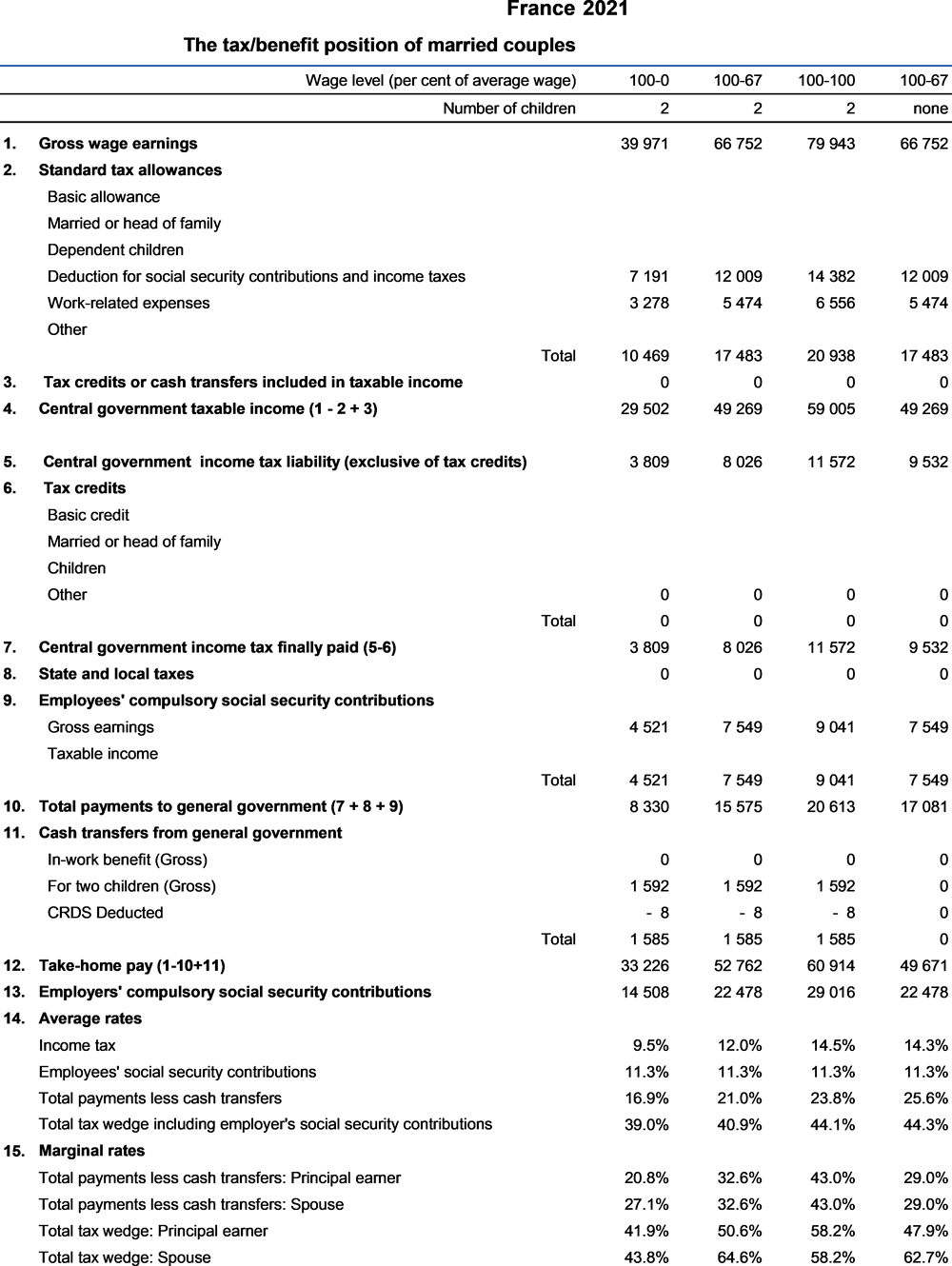

France Taxing Wages 2022 Impact Of Covid 19 On The Tax Wedge In Oecd Countries Oecd Ilibrary

Self Assessment Tax Dues To Be Paid By July 31 2020 Tax And Accounting Services For Domestic And Overseas Indians Gkmtax In

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Membership Dues Tax Deduction Info Teachers Association Of Long Beach